Introduction

As a Brazilian who moved to Europe (Barcelona which I love!) some years ago, in my more than 14 years working as a SAP Supply Chain Consultant I was part of many SAP projects in Brazil, and, unfortunately I have to say that 99,99% of the projects were highly stressful to all the people involved.

Being very honest, this always bothered me a lot, because in every project, we had the issue of losing a lot of time until all the stakeholders truly understood the challenge they were involved in.

In this post, I will describe my experience, what the main pitfalls the global teams face in Brazil are, and also what suggestions and strategies can be used to save a lot of time and money in SAP Brazilian projects (avoiding a lot of stress and impacts on the global templates).

Why is Brazil so complex?

First of all, Brazil has the size of a whole continent.

When we consider population, Brazil is expected to have around 217 million people in 2025, which is nearly equivalent to the combined population of France, the UK, Italy, and Spain.

This means that when we discuss logistics, things become pretty complicated.

However, it is not only that; the most challenging part of Brazil is its tax system.

If you are from Europe or the US and have never heard of the Brazilian Tax System, the first advice I can give you is: do not underestimate it (this is the main mistake global project teams make when starting a new project in Brazil).

To have in mind, if I check today (06/06/2025) how many OSS Notes were released by SAP exclusively for Brazil in 2025 for S/4Hana, I can see 259 OSS Notes, which means an average of 1.6 OSS Notes per day. (In some countries, we don’t have this for even 1 year.)

Also, when we think of the country structure, it is essential to take into consideration:

- There are around 17 different types of taxes in Brazil (Some are at the federal level, some at the state level, and some at the city level).

- There are more than 5.000 tax laws in Brazil.

- Tax authorities from each state (27 in total) request tax reports.

- The local language is Portuguese, and all legal documents must be in this language.

- All local invoices must be in the local currency, BRL (Brazilian Reais).

- All reporting is in Portuguese.

- The lax laws can change extremely quickly.

- You cannot move anything in Brazil without the official country invoice, which is called Nota Fiscal (if you work with Brazil, you will hear this name all the time).

- Brazil is a country where the government is constantly trying to apply tax fines to companies, and many times, the tax legislation can be “interpreted” in different ways depending on the tax authorities that audit the companies. This is why in SAP projects, the Tax Manager and Tax Director of any company are the main stakeholders of any local project.

Having said all of that, you can imagine how complex is an ERP implementation in Brazil.

Main Brazil Localization Impacts in SAP

After discussing some complexities about the country, I would like to share with you some information about Brazilian Localization in SAP and the main impacted modules.

In Brazil, unlike in other countries, taxes are closely tied to logistics. This means that when you have an SAP project in Brazil, the FI consultant will not handle the central taxation aspect as we do in other countries. In Brazil, all sales taxes are managed by the SD consultant, and purchasing taxes are handled by the MM consultant.

And why is that? Because depending on the process the company is performing (the type of sales, purchasing, import, export, etc), the taxes can change a lot and this is not only related about tax calculation, as we will see soon, we have impacts in many parts of the process itself because of localization.

Let me break it down into parts to be easier to understand.

Master Data

One of the main impacts that we have in SAP is related to Master Data.

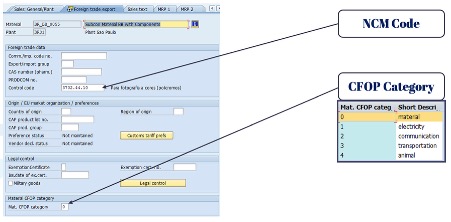

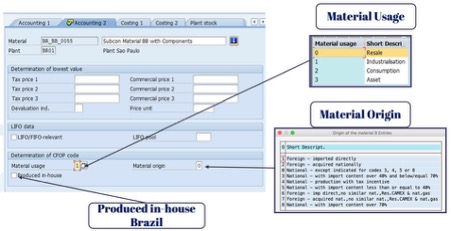

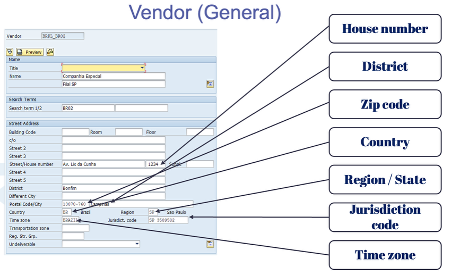

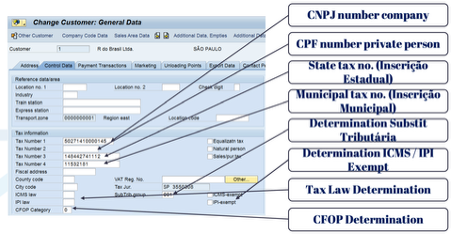

It is impressive when we start a rollout in Brazil and the Global Team already has the entire data migration plan designed, with all the necessary strategy in place (programs, etc.). They learn that we have several specific fields that must be filled in for the Brazil Localization to work correctly.

To give some examples, without the fields below filled in the material master, we cannot calculate taxes correctly:

Also, in the BP:

And so on!

Nota Fiscal

As I previously commented, a nota fiscal is required for every logistics operation in Brazil.

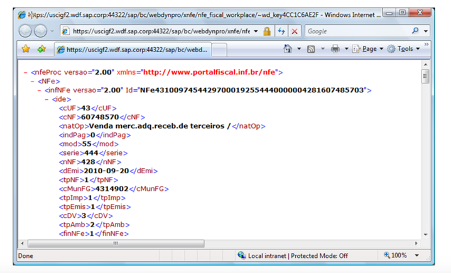

This document is generated directly by the system and sent to the government in XML format for approval.

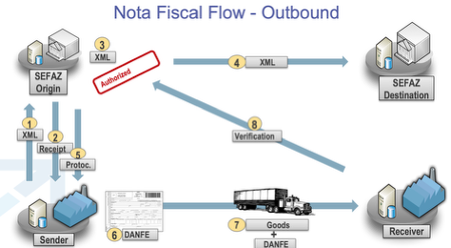

Below we can see an example of a sales flow (don’t get scared):

What is happening in the image above is:

- The sender is the company that is selling the goods.

- When the billing document is generated in SAP, the nota fiscal is generated in the system and sent to SEFAZ (government of the state of origin) for approval.

- If the goods are going to a different state in Brazil, the Origin Sefaz communicates with the Destination Sefaz. Both will check the whole XML file (it is a huge XML file with a lot of information about the goods, seller, buyer, tax ids, etc) and if everything is OK, the Sender will reveive the approval and the protocol number (Step 5), which is then recorded in the SAP tables.

- Only after that can the goods be physically moved to the customer’s location.

You may have noticed that we also have a document called “DANFE”, which is a printed version of the XML file that must be included (mandatory) inside the truck with the goods.

If a company moves goods without an approved Nota Fiscal, the consequences can be severe, with a substantial fine (the higher the company’s revenue, the higher the fine). So, it is very common to have a SAP go-live in Brazil where trucks are just blocking the company entrance and the roads around the DC/Factory because there are issues in the system and they cannot collect the goods to bring to the customers (sometimes even the police might appear to pressure for the situation to be solved if the traffic gets complicated).

It is a lot of pressure, especially on the SD team.

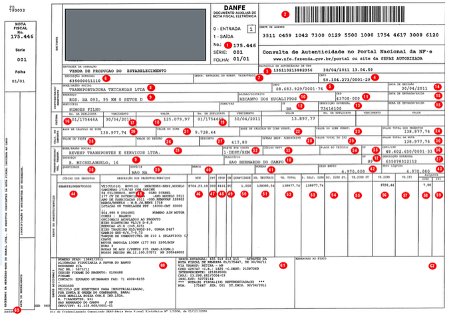

To make it a bit more “real”, below you can see a picture of a DANFE:

And also a Nota Fiscal XML File:

When discussing SAP itself, it is pretty standard to have numerous developments for both objects.

Depending on the customers, changes must be made to both objects, which are mandatory in any project (this is always the scope of any SAP implementation in Brazil).

Additional Systems

Import System

It is relatively standard for Brazilian companies to have additional systems to support their use of the SAP system.

Unfortunately, when it comes to import flows in Brazil, the complexity is immense, and I have never seen a company that can manage the entire flow solely within SAP (I highly recommend having an external system for that).

GRC / DRC System

As I mentioned above, when discussing Nota Fiscal, from an architectural perspective, we always need a system that will be positioned between the SAP system and the government. We cannot connect them directly.

SAP had a system called GRC-Nfe (now replaced by DRC), which performs exactly this job.

Other local companies in Brazil also provide this type of service.

You need to choose one for your implementation.

Legal Reports

In Brazil, we have numerous legal reports, making it impossible for SAP to deliver them all in a standard manner to its customers.

SAP provides TDF (if you purchase the additional license), but it is not inexpensive. Alternatively, you have the option to develop all of them yourself (and make all the necessary changes later on) or, again, to buy a third-party solution.

For me, developing all by itself is the worst path.

Export System

It is possible to have the export flows done directly from SAP, as Brazil does not currently have export taxes (although the government was discussing this some time ago). However, depending on the volume and complexity, this may also be necessary.

Typical Mistakes companies make in projects in Brazil

As promised, I would like to explain, in my view, the main pitfalls that global companies often struggle with in projects in Brazil.

Mistake # 1 – Underestimating Complexity

The main mistake I observed in 100% of the times I worked on Brazilian projects is related to the underestimation of complexity by global teams.

Typically, the teams are extremely experienced and highly knowledgeable, and they often believe they have already seen everything in SAP and can manage the implementation independently.

This is a huge mistake.

In 10 out of 10 instances, I encountered this situation, and the result was that the project had to be replanned, the budget had to be increased, and people were highly stressed.

Mistake # 2 – To believe that no local resources are needed

Another widespread mistake is that the global team comes up with an idea that they can bring their global integrator (usually large consulting companies) to implement the entire project with a predefined approach.

It is even amusing (and tragic) to recall how many times I witnessed this happening.

I’ve lost count of the number of times I’ve seen this situation: The team arrives in Brazil to conduct the workshops, demonstrates the approach to the rollout project, and the key users look at each other and say, “This will not work here.”

Mistake # 3 – To have a local team that is very inexperienced

A common situation in Brazil is the difficulty in finding resources with a good level of English to work on SAP projects.

This is a pity, because there are many excellent Brazilian SAP consultants, but many of them do not speak English, and therefore cannot participate in global projects.

This creates a situation where consulting companies attempt to hire consultants who possess a good level of English but have limited technical skills, which later causes many problems.

Mistake # 4 – Try to implement the global template without understanding the local flows

I know it might sound a bit strange to put this as a mistake, as the primary goal of a global rollout is to implement the core processes of the company in all the countries around the world, but, when you do a project in Brazil you will see that a lot of things make zero sense.

Many flows in the system are performed solely to be tax compliant, and in the majority of cases, they make no sense when considering process and cost optimization.

Mistake # 5 – Do the project 100% remotely

I saw many implementations that failed simply because people did not know each other.

There was a significant cultural and language barrier between global and local teams, which significantly delayed the projects and blocked many solution approvals.

This was solved by organizing local workshops where people could meet and destroy these barriers.

Mistake # 6 – Underestimating Testing

I think this mistake is one of the main ones in the project.

Unlike any other country, a simple sales flow can have up to 30 different tax variations. It is challenging to understand why all of them need to be tested (in the end, it is a simple Sales Order – Delivery – Billing process), but the business, especially the tax team, wants all of them to be tested.

Believe me, test all of them and avoid a nightmare go-live.

10 Suggestions to Avoid These Problems

And now, I want to give some suggestions that can change the way your SAP project can go in Brazil, and also to save a lot of money (millions) because of strategic mistakes.

#0 – Be Strategic

For me, the step 0 and the most important, is to have someone who has a lot of experience with Brazilian Projects to help from the first day of planning until the end of hypercare to be an advisor in all the parts of the process.

This person must be independent, as you don’t want anyone giving you advice from the integrator, for example. You need someone to focus on taking the best decision to reduce cost, and especially implementation time (I saw so many times projects that the budget had to be increased many times, and the project time just doubled or tripled).

This is the person who will help you to:

- Define the real project scope (working with business to define business scenarios (I am talking about this below)

- Define project timeline

- Interview local consultants and also define the team size

- Support for local tools to be implemented

- Validate configuration and enhancement efforts/costs related to Brazil Localization

- Design Integrated Test Plan

- Design User Acceptance Test Plan

- Support for Project Documentation – Collaborate with the integrator to develop a training plan.

- Support for Cutover Plan

- Support in the first weeks of go-live for ticket prioritization

The decision to have someone like this by the side of the global team can make the total difference in the project itself, as many “bad decisions” will be avoided, and millions can be saved.

If you are interested in having my support for your Brazilian Project Implementation, please feel free to contact me by email at bcpsantos@gmail.com.

#1 – Focus on preparation

Before starting any project, the first step is to organize a top management meeting between the global and local teams (with the Tax Director in attendance) to request a Logistics Process Book. This book should map all logistics processes, including tax implications, and provide one example of a Nota Fiscal for each scenario.

This is the best way to determine the scope’s size.

#2 – Define a realistic timeline

Don’t define the timeline without knowing the scope. It is extremely common to have a top-down decision to implement the project within a specific timeframe, which is usually very unrealistic because the decision-makers have simply no clue about the project’s complexity and size.

#3 – Be hard on the local team definition

Even knowing that it is not easy to find good resources for any project (especially in times of high demand), don’t give up on this topic.

To have a good team is extremely important for any implementation, and you should not outsource this activity to the integrator.

You must interview all the people who will be part of the project.

#4 – Have a very clear list of all local tools that are needed

Since the beginning of the project, map all the local tools that are already in use by the local business.

Please don’t underestimate the tools, as many of them can be connected to legal requirements (for example, specific quality reports for certain substances).

#5 – Test, test, and test

Don’t get tired of performing tests in the project.

One of the “dumbest” decisions someone can make in a project in Brazil is to reduce the test phase because of project delay.

This is basically one of the main phases, and 100% of all the logistic scenarios must be validated by the tax team.

#6 – Have dedicated local resources to the project

Have in your budget enough resources to have, if not all, the majority of resources on a full-time basis.

This is simply mandatory for the tax team.

Depending on the complexity of the company tax scenarios, it is necessary to have a few tax people to support the project team.

This is one of the reasons many projects’ design phase takes much longer than expected, as we can never design a process ourselves without tax validation.

#7 – Use the same test scenarios for Integrated and User Acceptance Tests

One of the main mistakes I see in projects is conducting a straightforward integrated test and a very complex user acceptance test.

Typically, everything works in the integrated test, but nothing works in the user acceptance tests.

If possible, the tax team should have already validated the integrated test scenarios, resulting in a significantly faster UAT execution pace.

#8 – Don’t accept all business requirements

Another common issue that arises is that, as Brazilian tax scenarios are very complex, after weeks or months of intense discussions, the global team becomes tired and starts to accept any business requirements, which makes the project scope overly broad.

Try to have a good team that understands the requirements and the volume involved in each type of operation deeply.

It is a critical point not to accept all requirements and to clearly distinguish between legal and tax requirements and what is a genuine requirement.

#9 – Require Detailed Training Sessions

Request from the local integrator team to prepare a detailed training material with all the implemented changes that are entirely related to Brazil Localization.

It is very common for teams to simplify too much in this phase. When the project is finished and the team is no longer there, processes that are not frequently used get lost, and nobody knows how to execute them properly.

#10 – Local Support

And lastly, but not least important, is the issue of support.

It is a huge mistake not to have local support in Brazil to check localization tickets.

Today, it is very common to have a huge AMS team in India for this, and some tickets can take months to be solved due to a lack of knowledge in Brazil Localization.

And worse than that, is that sometimes, a simple “flag” in SAP can stop the whole tax calculation and impact the company.

Conclusion

I hope you liked this post about projects in Brazil.

Being completely honest, writing this post made me recall many situations I’ve gone through over the last few years.

Some were very stressful, some were amazing, but the best part of all of this was making so many friends in different parts of the world.

I hope that my words will help you and your project run smoother and with much higher success!

And if you need help, feel free to email me: bcpsantos@gmail.com

Thank you very much,

— Bruno César

SAP Solution Architect